Member Portal Frequently Asked Questions

Your Member Portal gives you online and secure access to manage your Pension Fund account(s). Below find help to common questions asked.

If you can't find your answer, feel free to reach out to our Member Relations team for further assistance by calling 866.495.7322.

Getting Started with the Member Portal

If you are new to the Member Portal, below are some helpful steps to setting up your account.

-

After clicking the Get Started link/button in your Member Portal Welcome Email, follow the below steps to set up your two-factor authentication and password for the first time to gain access to your Member Portal. See example in the screenshot to the right.

This is an important step. In the drop-down, you are selecting the phone number that will be used each time you log in to the Member Portal in the future. We recommend using a mobile number if one is available.

-

Once you have selected the phone number you will use. Your next step is to select which method you will use to receive your security code.

Please note, if the number you selected was a landline, your only option available will be “Call Me.”

-

Collect the unique security code that was sent via text or call and enter the code into the box. Select “Verify” to continue.

If the code doesn’t work or you didn’t receive it, you can also select “Resend Security Code” to receive a new security code.

-

Once you have verified your identity using two-factor authentication, you will set up your password following the instructions on the screen.

Tip: For security purposes, we recommend storing this information in a secure place such as a password manager on your phone or other secure location. We do not recommend allowing your browser to ‘Remember Password.”

Managing Online Contributions

All online transactions are completed through our bank of record, Fifth Third. You can only access your Fifth Third portal by logging into the Member Portal and authenticating.

-

Q: How soon can I initiate a one-time contribution?

A: If you have opened a new account, you must first wait until your account is established and visible within the Member Portal. After you receive your welcome email, you can log in to request a one-time contribution through the Member Portal.

-

Q: Why am I being asked to select an image?

A: The first time you log in, you will be asked to choose a security image. This helps you know that you are safely logged into the Fifth Third portal. You will always authenticate and access the Fifth Third portal through your Pension Fund Member Portal.

Q: How soon can I initiate a recurring contribution?

A: We will be allowing payments to be made on the 1st and 15th of the month still but the good news is you can set up a recurring payment as late as the day before and have it run the next day.

Q: I'm trying to set up a recurring contribution, why can't I see my account in the drop-down list of available accounts?

A: There could be a few reasons that you do not see your account in the drop-down list.

- The account you are wanting to set up may already have a recurring contribution set up. Currently the Fifth Third site only allows for one recurring contribution per account.

- Your account is not eligible for recurring contributions. At this time, the only accounts eligible for recurring contributions are our IRA and BAA products. All employer-sponsored accounts like the Pension Plan and TDRA 403(b)/Roth 403(b) still have to be paid through your employer.

Member Tip: Your Pension Fund Member Portal should still be open in a different tab/window. Be sure you are referring to your Member Portal to ensure you are setting up your recurring contributions to the right accounts.

-

Q: I need to change an existing recurring contribution, how do I do that?

A: You will need to delete any existing recurring contribution and set up a new one.

-

Q: I updated my bank account information when I made a one-time contribution but I don't see the update when I log in to set up or manage my recurring contributions.

A: The Fifth Third banking portals that allow one-time contributions and the ability to setup and manage recurring contributions are different. You will only have to enter your banking account information one time in each portal but then it will be saved there for future contributions.

Member Tip: Pension Fund does not have access to see or know this information. If you update your information in the Fifth Third payment portals and you want Pension Fund to have it for withdraws, it is important that you also contact Member Relations and provide them with that information.

Beneficiary Management

Updating and managing your beneficiaries in the Member Portal ensures your benefits go to the right people—without delays or disputes. It’s quick, secure, and gives you peace of mind.

-

To view a summary of your beneficiaries across all accounts, you will navigate to the "My Beneficiaries" page under the "Beneficiaries" tab in the main navigation.

From this page, you can view and edit the personal information for each beneficiary, such as:

- Date of Birth

- Social Security Number

- Contact Information

If there is any missing or inaccurate information, you can make changes directly from this screen and click save.

Please note: Submitting this information will send it to Pension Fund for review. Changes will not be immediately visible in the Member Portal. Please allow 3-5 business days for the system to reflect the updated changes.

-

To manage your primary and contingent beneficiaries, you will navigate to the "Manage Beneficiaries" page under the "Beneficiaries" tab in the main navigation.

From this page, there are two options:

- Pension Accounts

- Non-Pension Account

Managing Your Pension Beneficiary Designations:

Generally, the terms of the Pension Plan govern how death benefits will be paid. However, when the terms of the Pension Plan direct death benefits be paid to your designated beneficiary (for example, in the event that you die without a surviving spouse, qualified domestic partner, surviving children, and/or dependent parents), the Five Year Certain Pension, the Pensioner Death Benefit, the Salary Continuation Benefit, and the Death Settlement, as applicable, will be paid to the beneficiary(ies) you designate on this form.

From the "Manage Beneficiaries" section, you can:

- View your marital status and spouse/qualified domestic partner information.

- View and add minor children under the age of 21.

- If not married, you can designate a primary and contingent beneficiary. If married, you can still designate contingent beneficiaries.

Please Note: If you have experienced a change in marital status, such as a divorce or death, and this differs from the status you originally reported when enrolling in the Pension Plan, you will also need to complete the Changes in Personal Information form. The completed form, along with any required documentation listed on it, can be emailed to pfcc1@pensionfund.org or securely uploaded to the My Profile Documents section in the Secure Uploads folder.

Managing Your Non-Pension Account Beneficiary Designations:

For all other non-pension accounts, you will need to select and designate your primary and contingent beneficiaries.

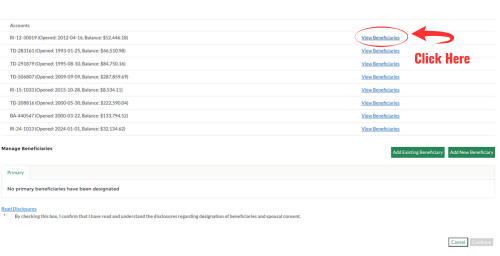

To view your beneficiaries associated with each account, you will select those accounts you wish to view and then select "continue." From here, you will find a "View Beneficiaries" link that displays your existing designated beneficiaries associated with each selected account.

From this screen, you have the option to keep the same beneficiaries listed under "View Beneficiaries" or you can designate new primary and contingent beneficiaries. You can also choose from an "Exisiting Beneficiary," who is someone already associated with your accounts or "Add New Beneficiary," who is someone that will then be associated with your accounts going forward.

Please Note: From this selection, all the same primary and contingent beneficiaries will apply. If you wish to select different beneficiaries for each account, you will need to click cancel and ONLY select the accounts in which to designate a beneficiary(ies) for and repeat this process.

-

In addition to designating your beneficiaries online, if you reside or have resided in a community or marital property state (which may include, but are not necessarily limited to, AZ, CA, ID, LA, NV, NM, PR, TX, WA, and WI) and you are married, your spouse may need to complete a Spousal Consent For Community Or Marital Property States form in order for you to name any one other than, or in addition to, your spouse as a beneficiary. If you are not currently married and you become married in the future, you must complete a new beneficiary designation request. It is your responsibility to determine if the spousal consent applies and to satisfy applicable state statutes. Your state may require the Spousal Consent For Community Or Marital Property States form to be signed in the presence of a Notary Public. IMPORTANT: If you reside in a community or marital property state and you do not secure spousal consent in accordance with your state's statutes, any beneficiary you designate on this form other than your spouse may not be valid.

If this applies to you, in addition to designating your beneficiaries online, please complete the Spousal Consent For Community or Marital Property States form, which also needs to be notarized, and securely upload to the Member Portal, emailed to pfcc1@pensionfund.org, or mailed.